Christmas is fast approaching and households across the UK will be getting ready to put up their festive lights – but you might not know how much they can cost and what it means for your increasing household bills.

This year, even a small amount of energy could mean concerns for British households as we all contend with higher than usual energy bills. However, the good news is that your Christmas tree lights are actually really energy efficient and less expensive than you probably think.

Last year, the average family had their Christmas tree up from November 26th to January 6th – a total of 43 days of dazzling lights, the majority of households used LED lights, which is good news for bills as they use less than normal halogen and incandescent bulbs.

An energy expert at Uswitch said “a household with a string of 200 LED fairy lights would expect to increase their bills by just 27p if used for 6 hours a day for 22 days over the whole festive period – that’s 0.2p per hour”

If you are considering selling your home, call David Phillip FRICS for a free market appraisal, and remember to get your photographs taken before the Christmas decorations go up.

David Phillip Estate Agents, 86, Leeds Road, Bramhope, Leeds, LS16 9AN t: 01134 676 400 W: davidphillip.co.uk

Covering Leeds, North Leeds, Bramhope, Leeds, Adel, Cookridge, Pool-in-Wharfedale, Otley and Huby

For the first time ever, last month, the HomeonFilm App had more video hits to it than Rightmove!

It is very significant that more and more buyers and renters are visiting https//homeonfilm.com/ and last month there has been a steady increase in leads to estate agency clients too.

Home on Film MD David Varley commented “We are delighted that people are viewing our client’s videos in the App in their thousands. We’ve recently added ‘viewing ‘ and ‘valuation’ forms to those videos, and this is steadily turning into more leads for clients utilising the App. We had over 6,597 video views during the last 30 days and overall over 30,000 views to the videos as a collective – it’s fantastic for our clients”

David Phillip commented “ at David Phillip Estate Agents we believe that our clients are not wholly interested in static literature and photographs, videos add a feeling of excitement and potential buyers feel much more involved and attracted in the property.

“to have achieved these numbers so quickly and to beat Rightmove is fantastic for Home on Film – anything that enables our vendor’s properties reach a greater audience and therefore a quicker chance of a sale is key to us – congratulations!”

For a free market appraisal call David Phillip FRICS on 01134 676 400, he’ll tell you how we are investing in enhanced property marketing and technology to ensure your property reaches a greater audience. w:davidphillip.co.uk e: info@davidphillip.co.uk

David Phillip Estate Agents, 86, Leeds Road, Bramhope, Leeds LS16 9AN, w: davidphillip.co.uk e: info@davidphillip.co.uk

Covering Leeds, North Leeds, Bramhope, Adel, Cookridge, Pool-in-Wharfedale, Otley and Huby

The surge in mortgage borrowing costs in recent months has cased widespread concern and contributed to the fall in some house prices, but the latest figures show that fixed rates are continuing to all from the highs they reached following September’s disastrous mini- Budget

The Bank of England’s Monetary Policy Committee’s decision to increase the base rate by 0.75% to 3% earlier this month – the eighth consecutive hike since December 2021 – has seen tracker mortgage rates rise, but fixed rate deals have got cheaper.

Lenders including Platform, Yorkshire Building Society, HSBC, Halifax, Lloyds and Nat West have all reduced their fixed rates in the last week.

The average two-year fix, which peaked at 6.65% on 20 October, according to Moneyfacts, now stands at 6.28% while the five-year fixed rate, which peaked at 6.51% now sits at 5.07%.

The fall is owed in part to the fact that gilt yields, which dictate the cost of government borrowing and impact mortgage rates have dropped back to pre-mini-Budget levels.

To add, market projections for how high interest rates will go next year have fallen sharply with most expecting the base rate to peak at 4.5%, 1.5% lower than predicted in the wake of September’s mini-Budget.

Some mortgage brokers are therefore forecasting that five-year fixed mortgage rates will fall back to 4 percent in the New Year.

Mark Harris, Chief Executive of mortgage broker SPF Private Clients commented “fixed -rate mortgages pricing has been edging down over the past few weeks and if this continues, we would expect five-year fixes below 4% by early 2023.

“with lenders reporting that volume and activity is falling away thanks to higher rates, it is a trend we expect to continue”

“that desire for pipeline and the falling cost of funds will incentivise lenders to reduce rates further, which will be welcome news for hard-pressed borrowers”

David Phillip commented “we hope this direction of fixed rate pricing will put some borrower’s mind at ease, as this activity from lenders suggests that a certain level of base rate has already been factored into the pricing of fixed mortgage rates.

“as the money markets have improved over the last few weeks, this has meant that the cost of money has also reduced, and those savings are being passed back to the mortgage lenders.”

Several lenders have already lowered rates this month

Platform, the mortgage arm of the Co-Operative bank, has released new mortgage rates taking several of its five year fixed rates to below 5%

Yorkshire Building Society has reduced its rates by up to 0.38%, with its cheapest now 5.34% on a two-year fixed deal.

HSBC has cut its rates by up to 0.29%, thanks to cheaper borrowing costs, while Virgin Money has also reduced its five-year fixed rate.

Swap rates – the contract by which lenders ‘swap’ payments on fixed interest rates with variable ones to offset the risk of a fixed rate have fallen in recent weeks, indicating that lenders have tempered their views on Higher interest rates in future.

Bank of England Governor Andrew Bailey said the next rate rise is unlikely to be as high as the market has priced in and should settle mortgage rates. But all eyes will be on the Chancellor’s Autumn fiscal statement tomorrow, as it will influence whether the bank of #england increase rates again when the MPC next meets on December 15

If you are considering selling your home, call David Phillip FRICS on 01134 676 400 for a free market appraisal.

David has over 30 year’s experience selling properties in North and West Yorkshire which is key when selling your property in ‘unusual’ market conditions – add that to his local knowledge and you can be sure that you are using an Estate Agent you can trust to sell your home professionally, at the best price and as quickly as possible.

David Phillip Estate Agents, 86, Leeds Road, Bramhope, Leeds LS16 9AN w:davidphillip.co.uk

Covering Leeds, North Leeds, Bramhope, Pool-in-Wharfedale, Adel, Cookridge, Otley and Huby

You’ve found your dream home, you are prepared to pay the full asking price and your offer has been accepted, and you are in the process of organising your mortgage but … the lender says that your potential new home isn’t worth the price tag and has been down valued.

Down-valuing is where a surveyor acting on behalf of a lender says a home is worth significantly less than the price agreed by the seller and the buyer and therefore they are unwilling to lend - in other words the lender won’t provide a loan to cover the seller’s full asking price. That’s because the valuation has revealed that the property isn’t worth what the seller is asking for and what the buyer has agreed to pay.

When carrying our a mortgage valuation the surveyor will take into account the following: -

You may have found a buyer and agreed an asking price of say £500,000, it is then down to their lender’s surveyor to find evidence to validate the asking price.

The lender will want reassurance that the property is worth what the buyer wants to borrow for it. But if the surveyor then values the property at say, £450,000, then that is a hefty down valuation of 10%, which can leave the seller and buyer in a tricky situation.

There are a number of reasons why a down-valuation may happen

Figures suggest that down-valuations are quite common, in fact Bankrate UK a mortgage comparison site found that in recent years, almost 46% of UK properties were down valued by lenders and homes valued between £400,000 and £500,000 have fallen victim to the most devaluations.

It is not unusual for properties to be down valued by lenders and whether you are a seller or a buyer, it is a situation that nobody wants to find themselves in but, there are ways around the problem.

If you are the seller

If you are the buyer

Whilst down-valuations are far from ideal, there is a way out, so don’t lose hope if this happens to you.

If you are considering selling your home, choose an Estate Agent that has been undertaking market appraisals for over 30 years. David Phillip FRICS has 100% valuation accuracy according to @allagents – in times when the market is a little uncertain, you know that you are dealing with an Estate Agent who has local experience and knowledge, which is absolutely key.

01134 676 400 David Phillip Estate Agents 86, Leeds Road, Bramhope, Leeds LS16 9AN. W: davidphillip.co.uk

Covering Bramhope, Adel, Cookridge, Huby, Pool-in Wharfedale and Otley

Each year, planners around the world engage in activities this week in celebration of World Town Planning Day. At David Phillip Estate Agents, we are pleased to work in partnership with ELG in Harrogate who provide advice around Residential planning.

If you are looking to buy a new home, the support and experience of a good planning company can guide you through any pitfalls you may encounter, these can range from the following :-

If you are looking to sell your home, then ELG can also help you get planning approval for any retrospective home improvements that may have taken place without the required planning approval, this may only become obvious at the property search stage as well as the above.

If you are considering selling your home and would like a free market appraisal call us on 01134 676 400, or if you have any specific questions around planning applications or the local property market in general then David Phillip FRICS who has over 30 year’s experience selling property will be able to help

David Phillip Estate Agents, 86, Leeds Road, Bramhope, Leeds w: davidphillip.co.uk e: info@davidphillip.co.uk

With the financial markets starting to calm, Andrew Bailey, the Governor of the bank of England says he expects to see mortgage rates fall.

Rates are typically priced off the market curve – where investors think Bank rates will be in the future, and so when that curve jumped after the mini-budget, mortgage rates inevitably increased.

Bailey commented at the end of last week “I would hope that is now calming, as the curve is falling and becoming more predictable.

The Governor of the Bank of England has warned the money markets that the interest rates will not rise as high as they have been – and issued a rebuke to lenders that mortgage costs do ”not need to rise as they have done”.

Bailey said that borrowing costs will peak at a lower level than traders are predicting, even as he announced the biggest interest rise in 30 years, he added “we can’t make promises about future interest rates but based on where we stand today, we think that Bank rates will have to go up by less than currently priced in the financial markets.

Bailey also suggested that fixed mortgage rates had peaked. “Rates on new fixed term mortgages should not need to rise as they have done” – he said

The Bank of England put rates up by 0.75% to 3% last week, despite this, some mortgage lenders have continued to re-introduce a sweep of fixed-fee mortgage deals, with some lenders cutting their rates by up to 0.45 percentage points.

On November 4th Lloyds owned Halifax, one of the largest lenders in the UK mortgage market, re-introduced a handful of £999 fixed-fee products at lower rates.

Clydesdale Bank, part of Virgin Money, has reduced rates by up to 0.25% on two and five-year deals with rates now sitting at 5.44%.

Skipton Building Society has also cut rates on five-year deals, introducing rates reduced by up to 0.29 percent, while YBS Commercial Mortgages has cut its rates by as much as 0.45 per cent and major lender Santander has updated its residential affordability calculator following the latest household expenditure figures published by the office of National Statistics.

David Phillip commented “currently, two-year rates are 4.3%, down from 5 percent at the beginning of October and although some of these changes are admittedly marginal, the rates are going in the right direction of travel and a relief for home-owners, with most lenders showing some reduction to what may be the new level”

He added “absurd as it sounds, you might find that more mortgage rates will reduce as the base rate has not increased as high as some feared. The base rate of 3% is not that high by historic standards, though many borrowers will have got used to the ultra-low rates following the financial crash of 2007-08”

If you are considering moving and would like advice on the position of the market, plus a free market appraisal call David Phillip FRICS on 01134 676 400.

86, Leeds Road, Bramhope, Leeds, LS16 9AN w:davidphillip.co.uk

Covering Leeds, North Leeds, Bramhope, Adel, Cookridge, Pool-in-Wharfedale, Otley and Huby

With bonfire night just around the corner, it is likely that you may be out visiting an organised bonfire and fireworks display. In Bramhope, we are lucky to have the Bramhope Village Scout Bonfire.

At times when people are away from their homes there are always opportunists who may see this as a time when houses are empty, however, there are a few simple precautions that you can take that should help keep burglars at bay whilst you are enjoying the fireworks

You can check for crime in your area by checking on the Police.uk website.

These are some tips to help keep your home protected, but in the meantime enjoy the firework display in Bramhope and also the organised events around Leeds over the next few days.

David Phillip Estate Agents, 86, Leeds Road, Bramhope, Leeds, LS16 9AN, t: 01134 676 400 w: davidphillip.co.uk.

Covering Leeds, North Leeds, Bramhope, Cookridge, Adel, Pool-in-Wharfedale, Otley.

Children and Adults love fireworks, but unfortunately our pets don’t. According to the RSPCA, it is estimated that 45% of dogs in the UK show signs of fear when they hear fireworks. Dogs ears are extremely sensitive when they hear loud bangs and whistles and some dogs may experience physical pain in their ears from the noise. Here are some tips on how to look after your pets on Bonfire night.

Keep all pets indoors and shut any windows and doors so they can’t run off if they do get frightened. If they do venture out into the garden, make sure it is secure just in case your dog decides to bolt if it is frightened, but don’t force them outside if they don’t want to venture beyond the house. Have your pets wear a tag in case they escape and ensure their microchip info is up to date.

Ensure that blinds and curtains are closed so that they can’t see the flashing lights of the fireworks and make sure that you have already walked your dog in daylight hours

Build pets a cosy den some days in advance in an area that they feel safe in, with lots of toys and blankets– this could mean an extra blanket on their bed. Ensure your pet has free rein of the house so that they don’t hurt themselves in a panic trying to escape. Give them extra cuddles and strokes to comfort them and keep them calm.

Ensure that their water bowl is topped up – anxious pets can get very thirsty

Turn up the TV or Music so they are distracted by familiar sounds – Classic FM has calming, classical music for pets on Friday 4th and Saturday 5th November from 5-9pm.

If you have pets that live outdoors, move them into their hutches and soundproof their cages.

We hope you enjoy the fireworks and bonfire night and that your pets are safe indoors and enjoy a peaceful night

David Phillip Estate Agents, 01134 676 400 a: 86, Leeds Road, Bramhope, Leeds, LS16 9AN, w:davidphillip.co.uk

Covering Leeds, North Leeds, Bramhope, Cookridge, Adel, Pool-in-Wharfedale, Otley and Huby

The Head of the UK’s biggest Estate Agency referral site, Martin McKenzie has called for more to be done to stop the practise of over-pricing homes to win instructions.

McKenzie specifically calls for Estate Agent trainers to stop teaching unscrupulous practises after it was found that at least one industry trainer advocates over-valuing as a deliberate strategy to win new instructions.

This comes on the back of an allAgents report highlighting that almost half of valuations are inaccurate.

Estate Agents who charge the highest commission fees are among those accused of overvaluing homes to lure sellers.

The National Association of Estate Agents has previously admitted some ‘unscrupulous agents’ try to win business by quoting a higher asking price.

McKenzie commented “this is completely unacceptable and must be stopped. Up until now, it was thought that overvaluing to win instructions was simply a tactic by unethical agents but the fact that valuers are being taught this as part of their training is quite simply wrong.

“The industry already has an unfavourable reputation with the public and hearing about these unprofessional practises simply helps reinforce this.

“Consumers should work with reputable agents that can provide comparable evidence to support their valuations. Consumers can also view statistics of previous valuation accuracy on their allAgents profile page”

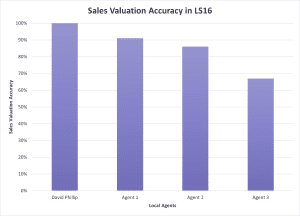

David Phillip Estate Agents have 100% sales valuation accuracy on the All Agents web site (this has been voted by our clients) – this is the highest of any Estate Agent in North Leeds (take a look on @allagents at our competitors rankings which are lower).

Data taken from the @allagents website – sales valuation accuracy in LS16 – David Phillip Estate Agents has 100% accuracy (they also have 100% in Sales fee satisfaction and 100% recommended too)

This figure is backed up backed up by the small number of price reductions by David Phillip on Rightmove.

David Phillip commented “I have been valuing properties successfully in North and West Yorkshire for over 30 years, so I am not surprised that we have the number one position at 100% sales valuation accuracy.

When conducting Market Appraisals, I am often astounded at the price other agents over-value properties - This price however is often quickly followed by a price reduction on Rightmove and a property frequently left hanging on the market – I completely agree with the comments made by Martin McKenzie - it is purely based around winning the instruction and therefore trying to achieve more commission, which doesn’t feel right – and not helpful to the vendor”

If you are considering selling your home and would like a free, ‘accurate’ market appraisal with David Phillip FRICS, please call 01134 676 400

David Phillip Estate Agents, 86, Leeds Road, Bramhope, Leeds LS16 9AN. W: davidphillip.co.uk

Covering Bramhope, Pool-in-Wharfedale, Adel, Cookridge Otley and Huby.

Lee Rowley has been re-appointed as Housing Minister the Department for Levelling Up, Housing and Communities has announced.

Rowley will continue in the role he was appointed to under Liz Truss’s Government last month

He was initially appointed in the role on 7th September however, the announcement was delayed due to the passing of The Queen.

He previously served as a Parliamentary under Secretary of State in the department for Business, Energy and Industrial strategy and a government whip as Lord Commissioner of the Treasury

Rowley was elected the Conservative MP for North-East Derbyshire on 8 June 2017

Rowley’s re-appointment makes him the 13th Housing Minister to take the position since the Conservatives came to power in 2010.

Rowley will serve under the re-appointed Secretary of State Michael Gove.

If you are considering selling your home and would like a free Market Appraisal call David Phillip FRICS on 01134 676 400.

86, Leeds Road, Bramhope, Leeds LS169AN w: davidphillip.co.uk

Covering Leeds, North Leeds, Bramhope, Cookridge, Adel, Pool-in-Wharfedale and Huby

"*" indicates required fields